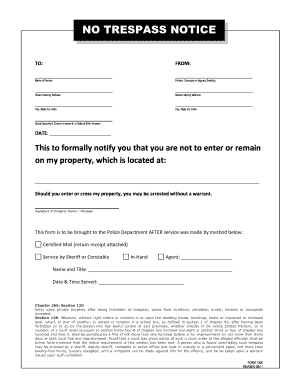

BoFA Hardship Letter free printable template

Show details

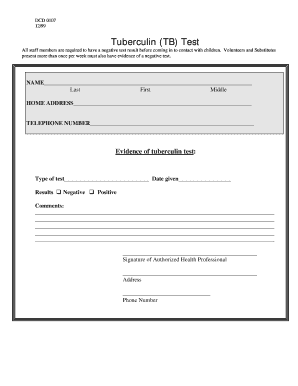

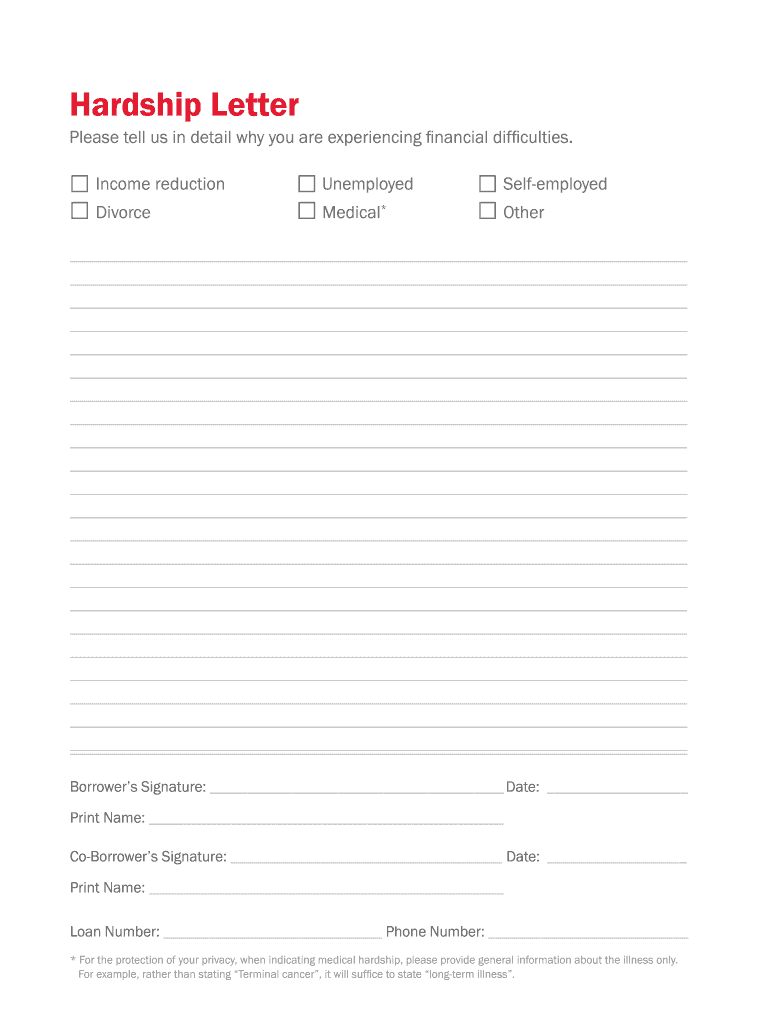

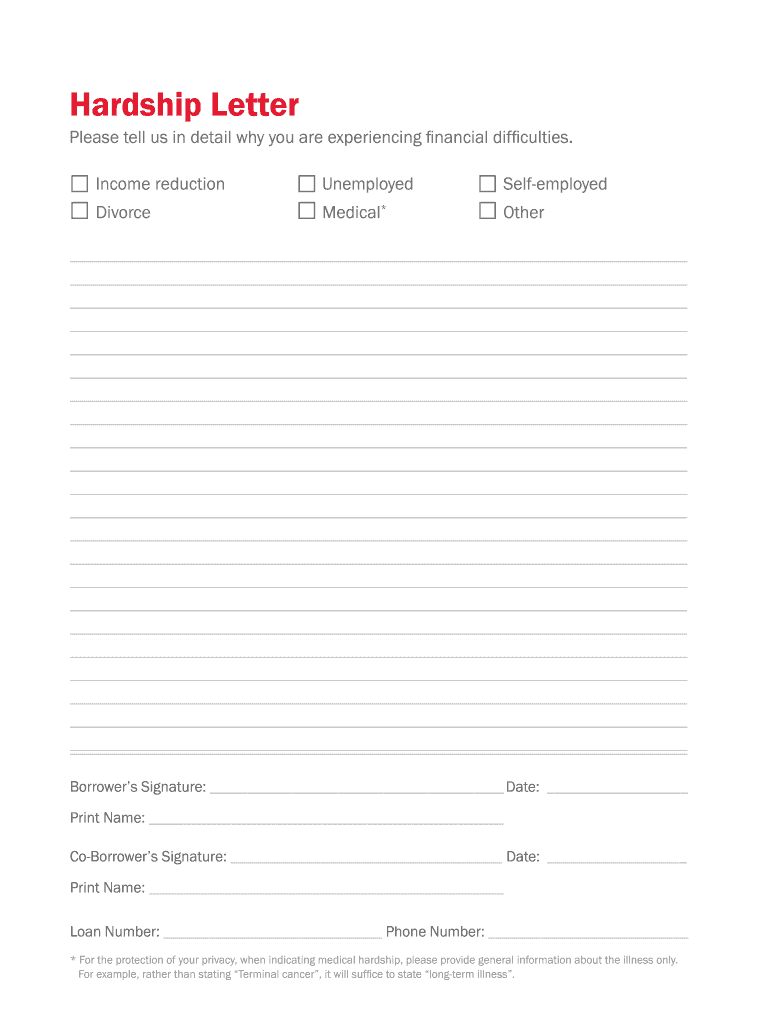

Hardship Letter Please tell us in detail why you are experiencing financial difficulties. Income reductionUnemployedSelfemployedDivorceMedical×Other Borrowers Signature: Date: Print Name: Borrowers

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign copy of a hardship letter form

Edit your hardship letter for mortgage form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your hardship letter template form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing hardship letters online

Follow the guidelines below to use a professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit hardship letter to mortgage company form. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out mortgage hardship letter form

How to fill out BoFA Hardship Letter

01

Begin with your contact information at the top of the letter.

02

Include the date you are writing the letter.

03

Next, provide the name and address of the financial institution (Bank of America).

04

Write a clear subject line, such as 'Hardship Letter'.

05

Start the letter with a formal greeting.

06

Clearly state your financial difficulties and the reasons for your hardship.

07

Provide any relevant details or background information that supports your situation.

08

Explain what assistance you are requesting (e.g., loan modification, deferment).

09

Offer any documentation that verifies your hardship (e.g., layoff notice, medical bills).

10

Conclude with a statement expressing your hope for a positive response and your willingness to discuss further.

11

Include your signature at the end of the letter.

Who needs BoFA Hardship Letter?

01

Borrowers who are facing financial difficulties, such as job loss or medical emergencies, and are unable to make their loan payments.

02

Individuals seeking assistance in modifying their loan terms or postponing payments.

03

Homeowners at risk of foreclosure looking for solutions to keep their home.

Fill

sample letter of hardship

: Try Risk Free

People Also Ask about sample hardship letter

What should I write in a hardship letter?

How to Write an Effective Hardship Letter Part 1: Explain what happened and why you are applying. Part 2: Specifically illustrate the time and severity of the hardship. Part 3: Back up the reasons traditional remedies won't work. Part 4: Detail why you are stable enough to succeed with a modification.

How do you explain financial hardship?

Tips for Writing a Hardship Letter Keep it original. Be honest. Keep it concise. Don't cast blame or shirk responsibility. Don't use jargon or fancy words. Keep your objectives in mind. Provide the creditor an action plan. Talk to a Financial Coach.

How do you write a letter for unable to pay?

I enclose a copy of my financial statement. This shows income and expenses for me. You will see from this information that I am unable to make any offer of payment at the moment. I am making every effort to increase my income and will contact you again as soon as my financial circumstances improve.

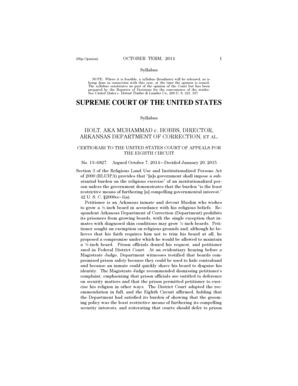

What is the reason for a hardship letter?

A hardship letter explains why a mortgage holder is defaulting on their loan and needs to sell their home for less than what they owe. Hardship may arise from unemployment, reduced income, a death in the family, divorce, military service, incarceration, or other situations.

How do I write a hardship letter?

How to Write an Effective Hardship Letter Part 1: Explain what happened and why you are applying. Part 2: Specifically illustrate the time and severity of the hardship. Part 3: Back up the reasons traditional remedies won't work. Part 4: Detail why you are stable enough to succeed with a modification.

What is a good reason for hardship?

The most common examples of hardship include: Illness or injury. Change of employment status. Loss of income.

What is an example of a letter of financial hardship?

To Whom It May Concern: I am writing this letter to explain my unfortunate set of circumstances that have caused us to become delinquent on our mortgage. We have done everything in our power to make ends meet but unfortunately we have fallen short and would like you to consider working with us to modify our loan.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in sample hardship letter for rental assistance without leaving Chrome?

Add pdfFiller Google Chrome Extension to your web browser to start editing how to write a hardship letter and other documents directly from a Google search page. The service allows you to make changes in your documents when viewing them in Chrome. Create fillable documents and edit existing PDFs from any internet-connected device with pdfFiller.

Can I edit sample hardship letter templates on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign financial hardship letter example on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

How do I complete ai write letter of hardship financial sample on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your pdffiller. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

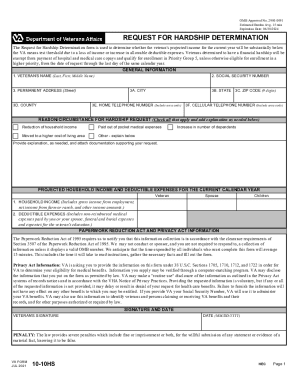

What is BoFA Hardship Letter?

A BoFA Hardship Letter is a written request submitted to Bank of America (BoFA) explaining a borrower's financial difficulties and requesting consideration for a loan modification or other relief.

Who is required to file BoFA Hardship Letter?

Borrowers who are experiencing financial hardships, such as loss of income or unexpected expenses, and are seeking to modify their mortgage or obtain assistance from Bank of America are required to file a BoFA Hardship Letter.

How to fill out BoFA Hardship Letter?

To fill out a BoFA Hardship Letter, borrowers should clearly state their financial situation, outline the circumstances causing the hardship, provide supporting documents, and specify the type of assistance requested.

What is the purpose of BoFA Hardship Letter?

The purpose of a BoFA Hardship Letter is to communicate to the bank the borrower's difficulties and request help in managing their mortgage obligations, potentially avoiding foreclosure.

What information must be reported on BoFA Hardship Letter?

The information that must be reported on a BoFA Hardship Letter includes details about the borrower's current financial situation, specific hardships faced, income sources, expenses, and any relevant documentation that supports the claim.

Fill out your BoFA Hardship Letter online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Hardship Letter Sample is not the form you're looking for?Search for another form here.

Keywords relevant to sample hardship letter pdf

Related to write a hardship letter

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.